Spotlight on Sentinel - Empowering Secure Access to Web 3.0

Computer Networking | November 2020

The multi-billion-dollar VPN industry is rapidly expanding. Whether it is for accessing geo-restricted content or increasing the security of the transmission of data accessed over the internet, individuals all over the world are demanding secure, affordable and reliable VPN services.

Sentinel’s ethos is to provide the privacy-preserving networking backbone for the internet, allowing entrepreneurs and existing organizations to establish their own white-labelled VPN at minimal cost or difficulty.

Sentinel launched in May 2018. Unaffected by the downturn in the crypto market, Sentinel has continued to develop and thrive on community efforts and minimal funds. It is ready to compete with a product that has shown glimmers of mass consumer adoption appeal.

The Sentinel Project will be transitioning onto (Cosmos) mainnet with over 100k users from Google Play Store and has its iOS app launching on the App Store in the coming weeks. Sentinel’s desktop and browser dVPN, known as the ‘v3 dVPN Client’ will be launched by the end of December 2020.

Upon migration to the Cosmos SDK-powered blockchain, Sentinel will be transitioning their native token. The token will possess a radically improved economic design on Sentinel mainnet. Existing holders of the $SENT holders will be able to swap pro-rata to the mainnet token. The SNT Foundation is planning on increasing its token supply through Cosmos SDK dPOS default inflation and block reward after the transition to the mainnet in a bid to boost its treasury reserve and ammunition for ecosystem incentive prog through an initial period of high inflation.

More details below.

Chat to Sentinel’s Core Team

Quick Links

Sentinel Website: https://sentinel.co/

Developer Docs: https://docs.sentinel.co/

Live network stats: http://stats.sentinel.co

Sentinel deck and whitepaper: https://docsend.com/view/s/hxq7ybq9khzmmnfc

Key Highlights

💎 Product differentiation — Sentinel offers a development framework and shared bandwidth resource pool allowing third-party developers to create centralized or decentralized applications utilizing VPN routing with ease, unlike alternative decentralized VPN players in the market offering only a single consumer-facing application.

📈 Traction — The adoption of the Sentinel network is growing at an exponential rate (approximately 40% month-on-month growth on the supply side). This traffic is serviced by Sentinel’s current node network which is based on an Ethereum testnet. The nodes are viewable at http://nodes.sentinel.co. Nodes will be transitioning onto Sentinel's Cosmos based testnet with the introduction of the new V3 dVPN Client.

✅ Product and commercial validation — SpiderVPN and Velocity (Two pre-existing centralized VPN providers) have successfully integrated with Sentinel, utilising its community-based node resource pool to deliver reliable VPN services to their end-customers. These integrations have proven Sentinel’s capability to cater to third-party developers. This is achieved by enabling them to easily access a shared resource pool of bandwidth providers and establish their own white-labelled dVPN company at minimal cost or difficulty (removing the difficulties of DCMA mitigation traditionally experienced by VPN companies).

👨💻🏆 CTO with a stellar reputation in the Cosmos ecosystem — achievements include: advancing to the secondround of GoogleCodeJam; qualifying three times for ACM ICPC regionals; ranking 1st five times at AI hackathons hosted by HackerEarth; competing against big organizations and winning two out of three categories in Game of Zones conducted by Cosmos/Interchain Foundation.

Key Metrics

$2M — Raised to date via a token sale (2018)

Supply-side

~320 — daily active bandwidth node providers

41% — month-over-month growth rate (six-month average)

Demand-side

~100k — Sentinel android application total downloads

~7300 — average daily number of sessions

~2500 GB — average daily data consumed across the Sentinel network

>700 TB — of data consumed in total across the Sentinel network

Source: http://stats.sentinel.co

What is Sentinel?

Sentinel’s mission is to re-architect the network layer for the internet, ensuring private and secure connections between all parties.

At its core, Sentinel is a globally accessible marketplace and hosting service for internet bandwidth. With the ability to purchase and consume internet bandwidth from anywhere in the world, Sentinel is primarily used — in a commercial setting — as a virtual private network (VPN) by individuals or businesses who want to access geo-restricted content, as well as protect their privacy when using the internet.

Unlike traditional centralised VPN providers where users purchase bandwidth from a single provider, Sentinel users buy bandwidth from a decentralised network of bandwidth sellers.

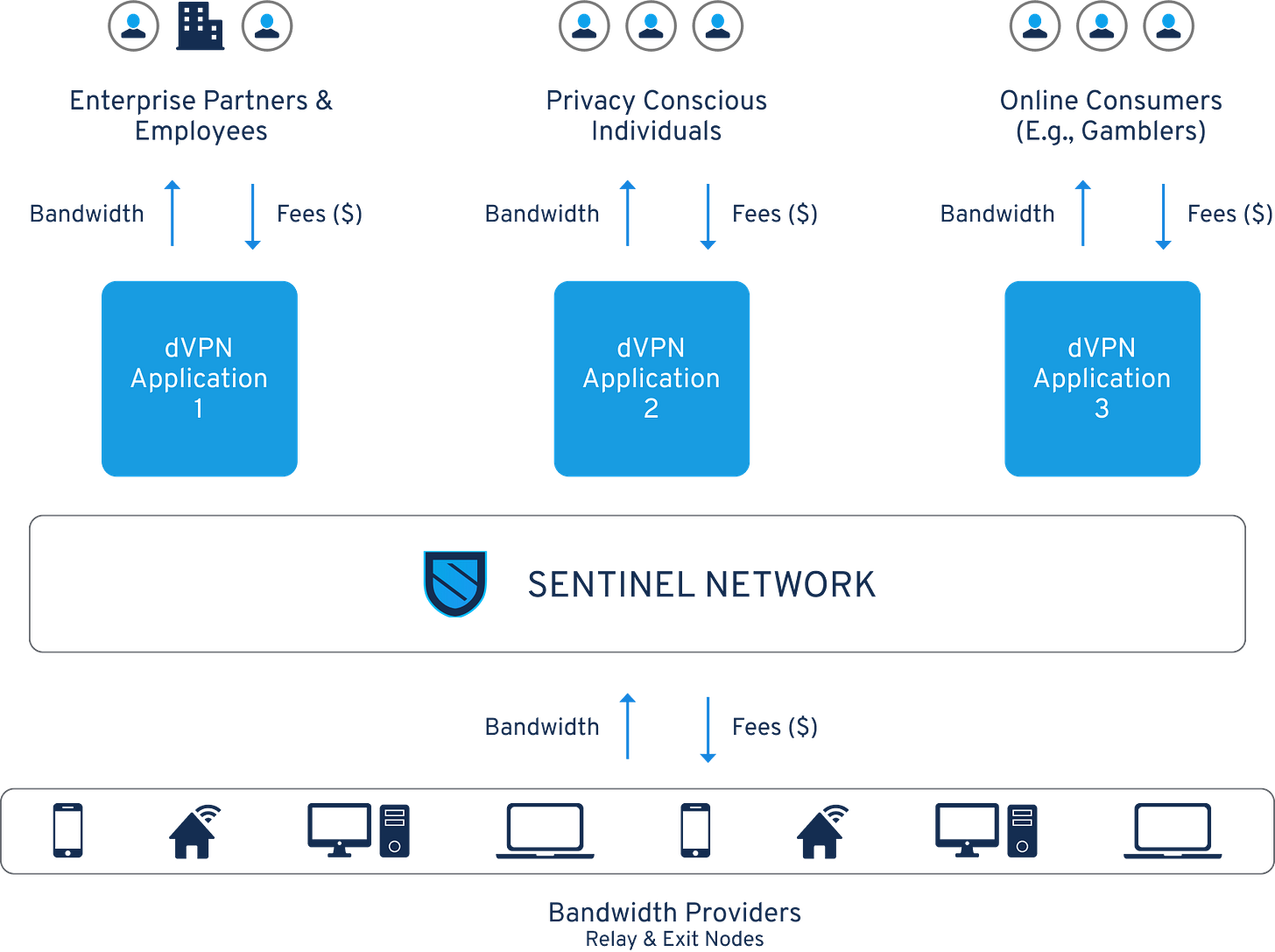

Sentinel, however, does not aim to just offer another siloed VPN service. Instead, it aims to service a variety of applications that wish to offer users access to the internet via private networks. These “dVPN applications” built on top of the Sentinel framework will utilise the same community-based node resource pool.

With the ability to build independent dVPN applications on top of the Sentinel protocol, Sentinel envisions itself a core component of the web3 stack.

Greg Osuri is a technologist and CEO of Akash Network, a Cosmos SDK blockchain-powered cloud computing marketplace.

Why Sentinel?

Centralized VPN services present an array of problems when compared to decentralized alternatives like Sentinel. The centralized VPN model is:

Exposure to a single point of failure — Centralized VPN servers offer a honeypot of information for hackers and/or government agencies to target.

Expensive to use — VPN service providers are often limited by supply due to the closed nature of their networks, leading to higher price points.

Not “provably” private —In most cases, it is impossible to examine whether the data is encrypted end-to-end since the code is closed-source.

Closed ecosystems — VPN service providers offer no income opportunities for individuals or businesses wishing to contribute to supporting the network.

Target Market

Demand Side Participants

Individuals/Retail

Privacy and security-conscious individuals.

Individuals wishing to access online applications, however, are victim to censorship by nation-states.

Enterprise businesses

Organisations that wish to offer employees secure and privacy-preserving access to their IT systems from remote locations.

Website or Mobile Application operators

Online service providers (e.g. online gambling services) who wish to offer VPN-access natively on their app or website in a bid to cater to end-users in geo-restricted areas.

Centralized VPN Service Providers

White-labelling Sentinel to existing or new VPN service providers who either do not have the resources to build out their own network or wish to capitalise on the privacy and security benefits the Sentinel network promises.

Supply Side Participants

Retail/Individuals

Retail users who have access to idle bandwidth or computing power and are looking for additional sources of income.

Datacenters/Professionalized node service providers

Cloud service providers with access to idle cloud computing and bandwidth looking to make additional revenue streams for their business.

Node providers for alternative blockchain networks that are looking at alternative higher-yielding income opportunities and/or have idle bandwidth resources they wish to monetize from.

Centralized VPN Providers

Existing centralized VPN service providers that have a pre-established network of entry/exit and relay nodes that have the capacity to service more customers.

Value Propositions

True privacy — Data travelling across the Sentinel network is encrypted end-to-end. Since the protocol is fully open-source, encryption practices can be audited and verified.

Security — The decentralised architecture eliminates centralized points of failure or attack.

Seamless and permissionless payments — Paying for bandwidth does not require a user to have a bank account that may not be accessible (due to geographical restrictions) or that may infringe a user’s privacy. Payments can be made with the user’s cryptocurrency (stable coin or native crypto-assets) of choice.

Fiat on-ramps — Ability to cater to the wider market through accepting traditional means of payment with nation-state fiat currencies.

Cost efficiency — Since Sentinel is an open network that allows for bandwidth providers to participate seamlessly with very low barriers-to-entry, the influx of underserved supply to the VPN market should theoretically allow for more efficient price discovery and a lower price equilibrium point.

How does Sentinel work?

Application Protocol (Layer 2)

The Sentinel networking and marketplace protocol are designed to seamlessly facilitate peer-to-peer interactions between bandwidth providers (supply side) and bandwidth/VPN consumers (demand side).

Bandwidth providers (supply side), however, can be split into two categories — each category performing a different role in the Sentinel network and taking on differing levels of risk and therefore, receive differing levels of compensation. The two categories are:

Relay nodes — Relay nodes are responsible for relaying requests to and from the demand-side users and the target server destination. Relay nodes are essential to achieving privacy in the Sentinel network. Since a user is not connecting directly with the bandwidth provider located at the desired destination thanks to the relay nodes sitting in-between, the user’s IP address and browsing data are not traceable to the source.

Exit nodes — Exit nodes are responsible for directly committing their bandwidth to the network and accessing the desired content on behalf of the users (demand side). Operators of exit nodes inherently take on more risk than relay nodes, as it is their IP address that is used to access the internet on behalf of demand-side users. This ultimately exposes the location-based IP address of the exit node to the public, which may be a cause for concern for exit node operators on a case-by-case basis. Therefore, exit nodes will be entitled to a greater percentage of the fees paid by bandwidth consumers than relay node providers.

Facilitating Trustless Transactions between Demand and Supply Side

Proof-of-Bandwidth

A fundamental problem facing decentralized marketplaces is proving to the network the correct amount of supply-side resources have been consumed. In the context of a dVPN network, supply-side bad actors could, in theory, falsify the amount of bandwidth they claim to have sold to demand-siders, thereby claiming more fees.

One of the key goals of the Sentinel ecosystem is to develop and implement the first-ever bandwidth provability protocol, or ‘Proof of Bandwidth’, to allow for trustless sharing of bandwidth.

The current implementation of the bandwidth provability protocol, which is being constructed on Sentinel’s Cosmos/Tendermint based network, involves the generation of ‘bandwidth signatures’ from both the service provider and user. These bandwidth signatures are essentially messages which consist of the bandwidth transmitted in the p2p connection within a pre-configured period of time. The service provider and the user each generate their own signatures which are each signed with their respective private key, and these signatures are then stored on-chain for provenance. This provenance ensures the p2p marketplace can function autonomously.

Blockchain Layer (Layer 1)

Despite forfeiting true decentralization, Sentinel — to date — has been servicing real-world demand and supply-side participants using the Ethereum testnet. The initial plan was to prove the concept and attain market validation before migrating to Ethereum.

However, with the unpredictable costs on Ethereum, this year Sentinel has decided to develop its own purpose-built Chain to achieve true decentralization, facilitate lower value transactions, mitigate the risks of ETH 2.0 delays and achieve transactional throughput comparable to web2.

After extensive research, Sentinel determined Cosmos SDK was the best way to go to build a new chain, purpose-built for Sentinel’s bandwidth marketplace and hosting service. The Tendermint PoS algorithm is more scalable, achieves faster finality and is the most battle-tested PoS consensus currently available.

Token Model Thesis — $SENT

Token Utility

Sentinel launched its token ($SENT) in May 2018 in a bid to bootstrap development, raising approximately $2m. Since then, the token has primarily been used as a medium-of-exchange in the Sentinel ecosystem.

Upon migration to the Cosmos SDK-powered blockchain, Sentinel will be transitioning to their native token. The token will possess a radically improved economic design on mainnet. Existing holders of the $SENT holders will be able to swap pro-rata to the mainnet token. The SNT Foundation is planning on increasing its token supply through Cosmos SDK dPOS default inflation and block reward after the transition to the mainnet in a bid to boost its treasury reserve and ammunition for ecosystem incentive prog through an initial period of high inflation.

New features will include:

Validating transactions — $SENT tokens must be staked by validators to be granted the rights to add blocks to the Sentinel blockchain.

Node host delegation (Governance) — The $SENT token will be used to participate in governance-related decisions as a form of ‘voting power’, where the magnitude of a user’s voting power is in direct correlation with the number of tokens they hold.

Collateral — The $SENT token will be used as collateral for a stable coin to facilitate node host payments.

Token Value Capture

Based on our analysis, we believe that the Sentinel token can hypothetically capture value by falling under three super asset classes:

Store of value — One of the key considerations of using Cosmos SDK is that Sentinel’s purpose-built blockchain must provide its own security. The requirement to hold and stake $SENT in a bid to secure the network gives the token inherent value accruing properties as it serves to lock up token supply and significantly reduce transaction velocity. Taking into consideration the fixed number of tokens that will ever be existence, we believe that the $SENT token has store-of-value like characteristics. This may be amplified in the future should the token climb in value and become more liquid across exchanges, making it an attractive contender for trustless collateral in financial and/or non-financial dApps built atop.

Capital asset — Sentinel offers transaction validators the ability to stake their tokens to be allowed to commit their compute resources to the network for block validation, in return for a yield (transaction fees and inflation rewards). It also offers $SENT stakers to earn a portion of the network’s cash flows; dVPN node hosts will be charged a 20% network fee on their earnings which will then be distributed to $SENT stakers. These two qualities display the productive qualities of the $SENT token in the Sentinel network, which inherently ties the value of the token with the aggregate usage of Sentinel usage and transaction volume.

Consumable asset — Transactions on the Sentinel network demand users to pay validators gas fees to process the transactions. Gas fees will be denominated in $SENT.

Go-to-Market Strategy

Members of the Sentinel community and several Sentinel core engineers have come together to incorporate a new for-profit entity called Exidio.

The efforts of Exidio aims to help accelerate the Sentinel network flywheel by supporting developers incorporate decentralised private networks into their applications by connecting with the Sentinel protocol.

Bootstrapping the Demand Side

Exidio will be working with entrepreneurs as well as existing companies in the VPN space to either construct a new dVPN application or transition an existing VPN network onto a dVPN network. Exidio will serve to streamline onboarding and customer retention by:

Integration support and easy-to-use APIs — Exidio will be focusing on actually carrying out the implementations and bridging these components together and customizing if required. Ready-built APIs will enable application developers to easily plug into the Sentinel network.

Open-source clients and white-labelled dVPN applications — Exidio will offer centralized VPN service providers and online service providers an out-of-the-box VPN mobile and the web client. Businesses will need to simply tailor clients to their branding guidelines before bringing it to market.

Dedicated support and maintenance services — Exidio will offer enterprise partners service level agreements (SLAs) to ensure that their technical needs are met and maintained.

Bootstrapping the Supply Side

Hardware Device

At present, becoming either a validator or bandwidth resource provider requires a degree of technical knowledge. Ultimately, this limits the rate in which the Sentinel supply side can grow due to its dependence on a specialist.

Inspired by the success of the Helium network, the Exidio team is planning on commercialising physical hardware devices that will offer users the capability to support the Sentinel network as bandwidth providers with no technical knowledge requirements.

Token Incentives

Sentinel will use tokens from its treasury to reward both validators and early bandwidth providers through inflation rewards.

Inflation Rate — Sentinel will follow an inflation schedule similar to the initial model proposed by Nakamoto for bitcoin to incentivize early adoption, early investors and early stakers. The initial inflation will be set to 49% and decrease by 6% every 6 months in a halving like a catalyst event.

Competition

Sentinel experiences competitive threats indirectly from substitute centralized VPN service providers and directly from alternative decentralised VPN networks.

The most prominent direct competitor that threatens the survival of Sentinel is the dVPN market leader, Orchid.

Orchid has several defensible qualities that supplant its position in the market, those being: significant VC-backing, token treasury reserves, and exchange liquidity.

However, Orchid's approach to network expansion is best compared with the likes of EOS in the layer 1 battle. Orchid uses four legacy centralized providers for their VPN nodes: PIA, bolehVPN, VPNSecure, and LiquidVPN. This permissioned approach to supply-side expansion limits the growth rate and jeopardises the long-term viability of the network due to risks of imbalances of power among network participants. The security and sustainability of the network are at risk as is not a peer-to-peer nor a decentralized network.

Orchid’s mission is to also dominate the VPN market with its single consumer-facing application. Meanwhile, Sentinel believes that the best approach to growing its network is by catering to the entire VPN value chain. They believe that this vision will not be achieved by launching and maintaining a single consumer-facing application, but by establishing and developing on a framework that can be used to create a network of independent, decentralized VPNs. We are seeing this model become validated as NordVPN and VPNSecure also recently rolled out this offering.

Aside from differing go-to-market approaches, Orchid exhibits several technical limitations that leave existing and former users dissatisfied. Technical limitations include, but are not limited to: Orchid’s commitment to Ethereum (and thereby inheriting its inefficiencies and unpredictabilities) and it’s semi-centralized and permissioned network of VPN servers that jeopardise user security and privacy.

Additionally, Sentinel has designed a new — first-of-its-kind — mechanism capable of verifying the amount of bandwidth consumed in the network in a truly decentralized manner. Verifying bandwidth consumption in a peer-to-peer crypto-network has been a fundamental problem, resulting in most dVPN networks — including Orchid — relying on the work of trusted intermediaries or ‘permissioned nodes’.

To further examine and compare the progress of Sentinel versus Orchid, we looked closely at the metrics, materials and code that were available to us. Our findings:

Downloads

Orchid has < 50,000 downloads on Google Play

Sentinel has >100,000 downloads on Google Play

Reviews

Orchid has a 4.2-star rating from 321 reviews.

Sentinel has a 4.7-star rating from 2,942 reviews.

Open Source

Orchid's code was not able to be compiled based on the code displayed on Github.

Sentinel's codebase is available on GitHub to configure and audit.

Functionality

Orchid does not give users the ability to select which node or geography they want to route their traffic.

Sentinel dVPN application allows full control over details (speed, uptime) and selection of worldwide nodes.

Governance — SNT Foundation

The SNT Foundation is responsible for managing the Sentinel treasury. There are 12 active members of the Foundation, each with equal voting rights. Some notable members include:

Milana Valmont — CEO of Kira Network

The core team of Exidio, the company committed to the development and growth of Sentinel

Core Development & Growth Team

The builders and dedicated commercial partner of the open-source Sentinel network are all part of Exidio, a development house and B2B consultancy committed to the Sentinel network and the Cosmos ecosystem.

Dan Edlebeck | CEO

13 years of experience leading companies and nonprofit organisations with a focus on growth. CEO of two startups in college, founded deedle connects, a blockchain marketing agency, and has been recognized in corporate, nonprofit, and startup communities for effectively scaling teams and projects.

A former consultant who worked with three blockchain projects helping them go-to-market and building their communities to tens of thousands of individuals.

MBA at Babson College and his bachelor's at UW-Madison.

Srinivas Baride | CTO

4+ years of professional experience in Backend, Frontend, Databases, Cloud, DevOps, and Blockchain consensus architecture and development.

Former development lead for several projects including Freeflix Media Suite, Cosmic Compass and FyleDrop.

Notable achievements: Advanced to 2nd round of Google CodeJam; Qualified thrice for ACM ICPC regionals; Ranked 1st five times at AI hackathons hosted by HackerEarth; Competed against big organizations and won 2 out of 3 categories in Game of Zones conducted by Cosmos/Interchain Foundation. He also won the Uptime category in the Game of Stakes competition conducted by Cosmos/Interchain Foundation.

Core developer of Sentinel dVPN protocol and infrastructure.

Peter Mancuso | COO

Over 12 years of experience leading diverse teams and bootstrapping companies.

Previously worked for Charles Schwab & Co, Inc. launching new strategic products, training and implementing new procedures for staff, and assisting with a merger of four RIAs.

Serial entrepreneur — founded several companies from 2008 to 2016, one of which was acquired.

MBA in Global Management from Babson College and his Bachelor of Science in Finance from The University of New Hampshire.

Exidio’s Advisor Team

Matt Caulfield | CEO of Oort

Scott Littlewood | Head of Southeast Asia, Tezos

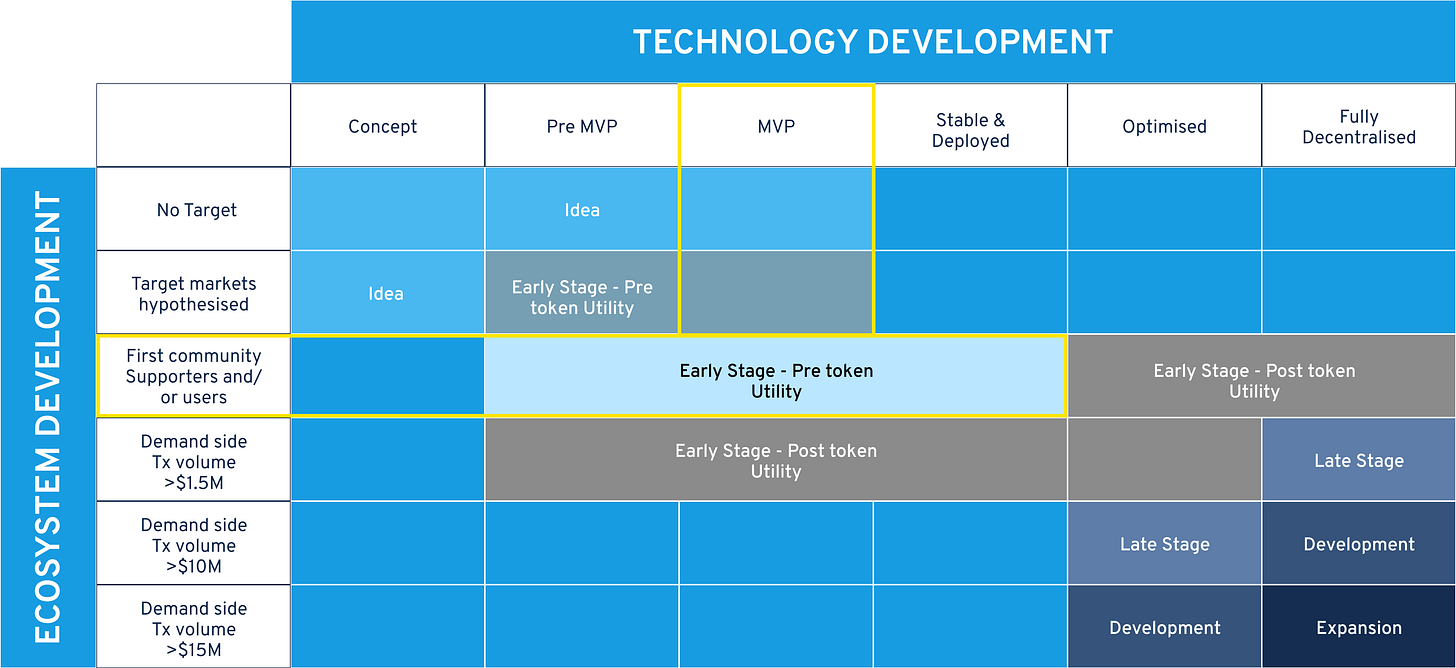

Stage of Maturity

Product Validation

Sentinel has already onboarded several demand-side and supply-side launch partners including SpiderVPN, Velocity, PIVX and the Handshake Network. Key highlights:

SpiderVPN — Exidio’s first paying customer has successfully integrated with Sentinel’s dVPN. SpiderVPN is now able to easily access Sentinel’s shared resource pool. Exidio supported SpiderVPN with the integration process via a custom-built API and provided them with a white-labelled user client.

PIVX — PIVX wanted to make their masternode hosting providers make more revenue through contributions to the Sentinel network by providing bandwidth.

Token Model Validation

The proposed token model is currently not live. Therefore at this stage, there is no concrete evidence to suggest that the proposed token hypothesis or value accrual properties of the token have been proven at this stage.

Product Development

Today

Sentinel network is live on the Ethereum testnet, successfully facilitating interactions between bandwidth sellers and buyers. Sentinel’s dVPN is available to download on https://sentinel.co/downloads

Traction

To access traction metrics in real-time, visit here.

Supply Side

Since Sentinel runs on Ethereum testnet, supply-siders do not earn any money in the form of either token inflation rewards or fees from demand-siders.

Despite this, Sentinel’s supply-side has surprisingly steadily grown over the last year driven by what we believe is belief and commitment to the long-term success of the network by a growing community of dedicated individuals and businesses.

Demand Side

The Sentinel dVPN android app has crossed 100,000 unique downloads.

It has a 4.7-star rating and over 2,800 independent reviews on Google Play.

The adoption of the Sentinel network is growing at an exponential rate. Usage and customer retention can be assessed by reviewing network statistics that include:

The number of sessions active — How many individuals or businesses at any given moment in time is connected to the Sentinel network.

Data consumed — The amount of data being channelled across the Sentinel network and being consumed by demand-siders.

Session duration — The amount of time demand-siders are spending on accessing bandwidth via the Sentinel portal.

Chat to Sentinel’s Core Team

Disclosures

The Rarestone team is consulting the Sentinel Foundation and is reviewing a potential investment in $SENT. This is meant to disclose any perceived conflict of interest and should not be mistaken as a recommendation to purchase $SENT tokens. This overview has been prepared solely for informational purposes and is not to be considered as investment advice. It does not purport to contain all of the information that may be required or desirable to evaluate all of the factors that might be relevant to a potential investor, and any recipient hereof should conduct its own due diligence investigation and analysis to make an independent determination of the suitability and consequences of any action.